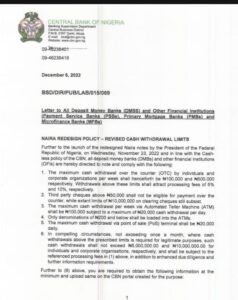

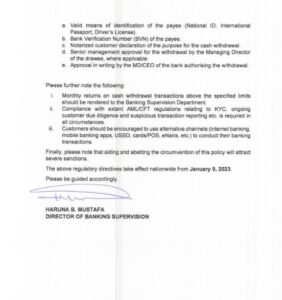

The revised cash withdrawal limits are contained in a circular the CBN issued on December 6, with the apex bank stating the policy would take effect nationwide from January 9, 2023.

The Apex bank in a mission to eradicate money laundry and effect policy to strategise to check the unregulated circulation of currency in the country a week before the commencement of the circulation of the newly redesigned naira notes.

CBN’s intention regarding the new policy is not clear enough but Financial Analysts believe it may not be unconnected with the naira redesign policy, which the CBN initiated to check the unregulated circulation of over 80 percent of funds in circulation.

The policy stated that maximum cash withdrawal via an automated teller machine (ATM) shall be restricted to N100,000 subject to a maximum of N20,000 cash withdrawal per day. It further restricts point of sales (POS) withdrawal to N20,000 daily.

The policy states that only denominations of N200 notes and below shall be loaded in all automated teller machines (ATM).

The new policy, according to the CBN, encourages customers to use alternative channels like internet banking, mobile banking App, and eNaira for financial transactions.

After the policy takes effect, all cash withdrawals in excess of the stated limits for individuals and corporate entities will attract processing fees of 5 percent and 10 percent respectively.